- The Bank of England might not implement another significant rate hike next week.

- Investors remain confident in a stronger pound.

- The Bank of England will likely boost rates by a quarter-point to 5.25%.

The GBP/USD weekly forecast is slightly bearish as investors have lowered expectations for a significant BOE rate hike.

Ups and downs of GBP/USD

GBP/USD had a volatile week where the price witnessed fluctuations, closing nearly flat.

-Are you looking for the best CFD broker? Check our detailed guide-

Central bank decisions this week strengthened the belief that the Bank of England won’t implement another significant rate hike next week. However, investors remain confident in a stronger pound. Moreover, they have maintained their most valuable bullish position on sterling since 2014.

Notably, data from the US highlighted the strength of the economy. As a result, the dollar strengthened, leading to a decline in GBP/USD.

Additionally, the FOMC meeting during the week resulted in a rate hike, further bolstering the dollar.

Next week’s key events for GBP/USD

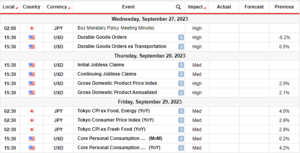

Next week will see the release of major economic reports from the US and the UK. These will likely cause massive price swings for the pair. Investors will focus on two major events. US employment data and the BOE policy meeting.

On August 3, the Bank of England will likely raise rates by a quarter-point to 5.25%. However, there is a risk of a repeat of June’s surprise half-point hike due to inflation remaining higher than in other major economies.

Notably, the Fed and the European Central Bank raised interest rates by a quarter of a percentage point this week.

GBP/USD weekly technical forecast: Bulls vs. bears as price dips below 22-SMA.

GBP/USD is trading at a pivotal level in the daily chart. The price has broken below the 22-SMA, but the RSI is slightly above 50. This indicates a struggle for dominance between bulls and bears.

-If you are interested in guaranteed stop-loss forex brokers, check our detailed guide-

Bears entered the market at the 1.3127 resistance level, pushing the price down to the 1.2801 support. Although they broke below the 22-SMA, they still face strong support at 1.2801.

In the coming week, bears will break below this support or fail, allowing bulls to continue the previous trend. A win for bears would mean a retest of the 1.2603 support. On the other hand, a victory for the bulls would mean a retest of the 1.3127 resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/gbp-usd-weekly-forecast-traders-dial-back-on-jumbo-hike-bets/

- :has

- :is

- :not

- :where

- 1

- 167

- 2014

- 30

- 300

- 50

- a

- above

- Accounts

- Allowing

- Although

- and

- Another

- ARE

- AS

- At

- AUGUST

- back

- Bank

- Bank of England

- bearish

- Bears

- belief

- below

- BEST

- Bets

- between

- BoE

- boost

- Break

- Broke

- Broken

- broker

- brokers

- Bullish

- Bulls

- but

- by

- CAN

- Cause

- central

- Central Bank

- CFD

- CFD Broker

- CFDs

- Chart

- check

- closing

- coming

- confident

- Consider

- Container

- continue

- daily

- data

- decisions

- Decline

- detailed

- Dollar

- Dominance

- down

- downs

- due

- during

- Economic

- economies

- economy

- employment

- England

- entered

- European

- European Central Bank

- events

- expectations

- Face

- FAIL

- Fed

- flat

- fluctuations

- Focus

- FOMC

- For

- Forecast

- forex

- Forex Brokers

- from

- further

- GBP/USD

- had

- hand

- Have

- High

- higher

- Highlighted

- Hike

- However

- HTTPS

- implement

- in

- In other

- indicates

- inflation

- interest

- Interest Rates

- interested

- Invest

- investor

- Investors

- Key

- leading

- Level

- likely

- looking

- lose

- losing

- lowered

- major

- Market

- massive

- max-width

- mean

- meeting

- might

- money

- Moreover

- most

- my

- nearly

- next

- next week

- now

- of

- on

- or

- Other

- our

- pair

- percentage

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- Point

- policy

- position

- pound

- previous

- price

- price dips

- provider

- Pushing

- Quarter

- raise

- raised

- Rate

- Rate Hike

- Rates

- release

- remain

- remaining

- repeat

- Reports

- Resistance

- result

- resulted

- retail

- Risk

- ROW

- rsi

- see

- should

- significant

- since

- sterling

- Still

- strength

- strong

- stronger

- Struggle

- support

- surprise

- SVG

- Swings

- T

- Take

- Technical

- than

- that

- The

- the Fed

- the UK

- their

- There.

- These

- they

- this

- this week

- to

- trade

- Traders

- Trading

- Trend

- two

- Uk

- UPS

- us

- Valuable

- victory

- volatile

- vs

- week

- weekly

- when

- whether

- will

- win

- with

- witnessed

- Won

- would

- you

- Your

- zephyrnet