WASHINGTON — Like other companies that build satellites for the U.S. government, L3Harris Technologies is looking for suppliers that can meet the technical and schedule demands of national security programs.

Defense and intelligence agencies want to take advantage of commercial space products but they also have unique demands, “so supply chain is a tough problem,” Kelle Wendling, president of space systems at L3Harris, told SpaceNews in a recent interview.

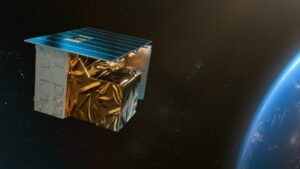

Schedule setbacks caused by supplier issues delayed the delivery of four missile-detection tracking satellites L3Harris built for the U.S. Space Force’s Space Development Agency.

These satellites will be part of a large network of sensors in low Earth orbit known as the Transport Layer. They were projected to ride to orbit along with other SDA Tranche 0 satellites in two recent launches but they were not ready. They are now on track to launch in October on USSF-124 with two Missile Defense Agency infrared sensor satellites.

Wendling said the delay turned out to be a silver lining because it will allow SDA and MDA to test the four wide-field-of-view infrared satellites made L3Harris next to MDA’s two medium-field-of-view prototype satellites, one of which was made by L3Harris

L3Harris will be pursuing other SDA contracts, and a key challenge is to meet the agency’s demanding schedule targets, said Wendling. L3Harris in July won a contract to build 14 Tracking Layer Tranche 1 satellites that are projected to launch in 2025. The company also will be competing for a Tracking Layer Tranche 2 contract and for a prototype constellation of classified tracking satellites that SDA recently announced.

“And so it definitely is going to be a cost and schedule challenge going forward,” said Wendling, who has been in charge of L3Harris’ space sector for the past 18 months.

The company builds satellites for the Defense Department and intelligence agencies, as well as for NASA and the National Oceanic and Atmospheric Administration. Wendling said SDA, in particular, “is forcing us to change the way we’re doing business, which I think is needed if we’re going to be responsive to our adversaries.”

Seeking supplier partners

As it pursues new contracts, L3Harris is in talks with satellite bus suppliers.

“The conversations are about what can I get on orbit, not only from a lead time perspective, but also replenishment,” said Wendling.

SDA’s Tranche 0 satellites used a Moog bus and Tranche 1 satellites will be built on a Maxar bus. No decisions have been made yet on a bus supplier for the Tranche 2 bid, Wendling said. “We are talking to all the bus providers because cost and schedule are a big deal.”

L3Harris is discussing opportunities with Airbus, Ball Aerospace, Terran Orbital and others, she said. “We are looking at all options. We are ‘bus agnostic’ and we’ve put together a bus strategy that says I need to be as common as possible.”

Wendling said L3Harris seeks vendors that are investing in product improvements that would also benefit SDA’s and other government satellites.

“For Tranche 0 we had Moog. We went with Maxar for Tranche 1. So we are evaluating whether or not that makes sense to stay with them for Tranche 2,” she said.

Delivery timelines are top of mind, she said. “Bus lead times today are at least a year … And not having a bus ready when the payload is ready is too costly for anybody, especially in a fixed-price contract.”

L3Harris is watching the products suppliers across the industry are building and asking whether bus providers are prepared to invest in upgrades, for example, to build satellites for different orbits.

“As we look at medium, geostationary, cislunar, we’re looking at who’s got roadmaps that take capabilities further and higher,” she said. “And who is going to be that long-term investor of their own dollars in advancing capabilities so that we don’t always have to pay the NRE,” or non-recurring engineering cost.

L3Harris asks potential suppliers “how committed they are to the government environment, which is different from the commercial business model,” said Wendling. “They really have to be committed. Can they really make something to the specifications the government needs? And are they in it for the long term?”

DoD and intelligence agencies are procuring satellites in ways that leverage commercial products, she said, but there’s still a “lot of bespoke.”

Discussions with Blue Origin

L3Harris produces satellites in Melbourne, Florida, not far from where Blue Origin is building hardware for its New Glenn rocket.

“We’re interested in some of their capabilities,” said Wendling, such as a payload ring adapter that Blue Origin designed to carry small satellites to orbit as secondary payloads — similar to the ESPA rings that are used on large rockets today.

L3Harris is eyeing Blue’s payload adapter as a future option to launch small satellites for government customers, said Wendling.

The company also is in discussion with other launch providers that could support government missions. L3Harris recently announced an agreement with Firefly Aerospace to launch three satellites for an intelligence agency in 2026.

Integration of Aerojet Rocketdyne

The recent acquisition of rocket and missile engine manufacturer Aerojet Rocketdyne gives L3Harris Technologies — a $17 billion-a-year defense contractor —a much larger footprint in the space sector.

Aerojet Rocketdyne is now one of L3Harris’ four major business units.

Wendling said she is looking at opportunities to use Aerojet’s propulsion systems for satellites that L3Harris would build for the U.S. military, for example.

DoD is talking about procuring satellites with some capability to maneuver, said Wendling. “We need guidance, navigation and control inside of the satellite and in the bus to be able to do ‘protect and defend’ missions or other necessary maneuvers.”

As L3Harris continues to absorb Aerojet’s operations, said Wendling, there will be more discussions about what technologies can be applied to future satellites. “I think we’re going to start with their propulsion systems, and see what else we can do with guidance, navigation and control, to help with some of the newer missions, whether they’re offensive or defensive.”

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://spacenews.com/l3harris-exploring-supplier-partnerships-for-its-satellite-business/

- :has

- :is

- :not

- :where

- 1

- 14

- 2025

- 2026

- a

- Able

- About

- across

- administration

- advancing

- ADvantage

- Aerospace

- agencies

- agency

- Airbus

- All

- allow

- along

- also

- always

- an

- and

- announced

- applied

- ARE

- AS

- asking

- At

- atmospheric

- ball

- BE

- because

- been

- benefit

- bespoke

- bid

- Big

- Blue

- build

- Building

- builds

- built

- bus

- business

- business model

- but

- by

- CAN

- capabilities

- capability

- carry

- chain

- challenge

- change

- charge

- classified

- commercial

- committed

- Common

- Companies

- company

- competing

- continues

- contract

- Contractor

- contracts

- control

- conversations

- Cost

- costly

- could

- Customers

- deal

- decisions

- Defense

- Defense Department

- defensive

- definitely

- delay

- Delayed

- delivery

- demanding

- demands

- Department

- Development

- different

- discussing

- discussion

- discussions

- do

- doing

- dollars

- Dont

- earth

- else

- Engine

- Engineering

- Environment

- especially

- evaluating

- example

- Exploring

- far

- florida

- Footprint

- For

- Forward

- four

- from

- further

- future

- get

- gives

- going

- got

- Government

- guidance

- had

- Have

- having

- help

- higher

- HTTPS

- i

- if

- improvements

- in

- industry

- inside

- Intelligence

- interested

- Interview

- Invest

- investing

- investor

- IT

- ITS

- July

- Key

- known

- large

- larger

- launch

- launches

- layer

- lead

- least

- Leverage

- like

- lining

- Long

- long-term

- Look

- looking

- Low

- made

- major

- make

- MAKES

- Manufacturer

- max-width

- medium

- Meet

- Melbourne

- Military

- mind

- missions

- model

- months

- more

- much

- Nasa

- National

- national security

- Navigation

- necessary

- Need

- needed

- needs

- New

- newer

- next

- no

- now

- october

- of

- offensive

- on

- ONE

- only

- Operations

- opportunities

- Option

- Options

- or

- Orbit

- Origin

- Other

- Others

- our

- out

- own

- part

- particular

- partnerships

- past

- Pay

- perspective

- plato

- Plato Data Intelligence

- PlatoData

- possible

- potential

- prepared

- president

- Problem

- produces

- Product

- Products

- Programs

- projected

- propulsion

- prototype

- providers

- Pursues

- put

- ready

- really

- recent

- recently

- responsive

- Ride

- Ring

- roadmaps

- rocket

- s

- Said

- satellite

- satellites

- says

- schedule

- secondary

- sector

- security

- see

- Seeks

- sense

- sensors

- Setbacks

- she

- Silver

- silver lining

- similar

- small

- So

- some

- something

- Space

- specifications

- start

- stay

- Still

- Strategy

- such

- supplier

- suppliers

- supply

- supply chain

- support

- Systems

- Take

- talking

- Talks

- targets

- Technical

- Technologies

- term

- test

- that

- The

- their

- Them

- There.

- they

- think

- three

- time

- timelines

- times

- to

- today

- together

- told

- too

- top

- tough

- track

- Tracking

- transport

- Turned

- two

- u.s.

- U.S. government

- unique

- units

- upgrades

- us

- use

- used

- vendors

- want

- was

- watching

- Way..

- ways

- we

- WELL

- went

- were

- What

- when

- whether

- which

- WHO

- will

- with

- Won

- would

- year

- yet

- zephyrnet